Mobiletopup.co.uk is a certified reseller of PaysafeCard

Creating a paysafecard Account: A Step-by-Step Guide

Creating a paysafecard account (also called MyPaysafe account) is your gateway to effortless and secure online transactions. In this guide, we'll navigate you through the process seamlessly, highlighting the advantages of creating your account, detailing essential requirements, and addressing critical security considerations. Before we dive into the steps of creating an account, here’s what you will learn from our guide:

- The simple and easy steps to creating a paysafecard account within a few minutes.

- The benefits of a paysafecard account, such as easy payments and improved security measures.

- The account requirements, such as minimum age and identification documents.

- The key limitations of a paysafecard account, including funding restrictions and withdrawal considerations.

- The advanced security measures that protect the creation and use of your paysafecard account, enabling you to make online transactions with peace of mind.

How to create a paysafecard account step-by-step

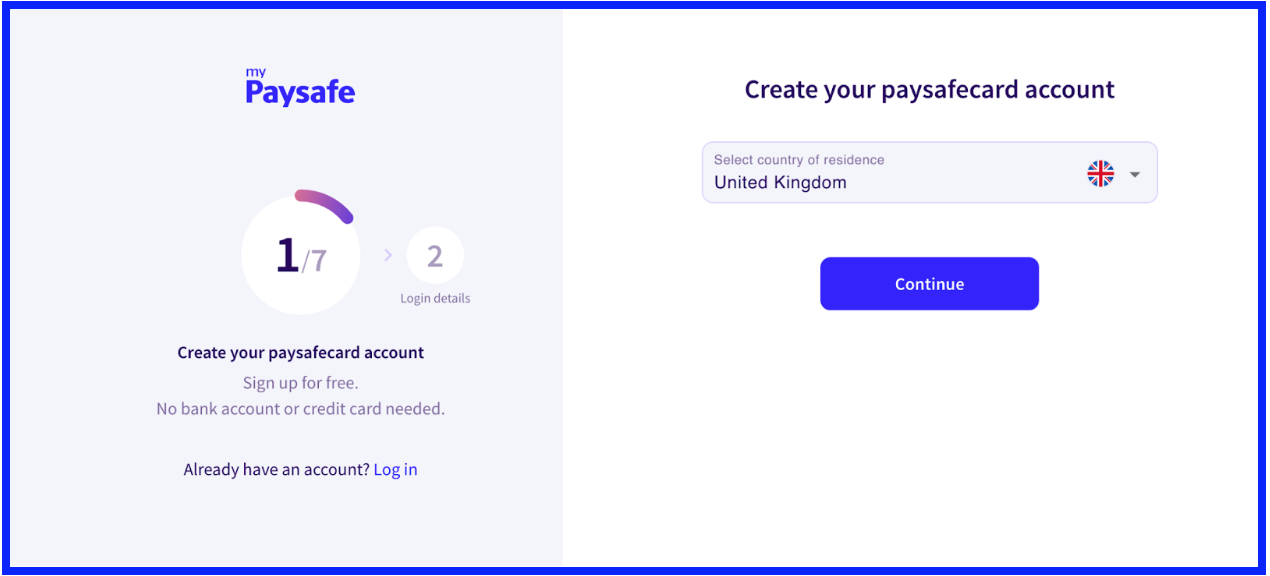

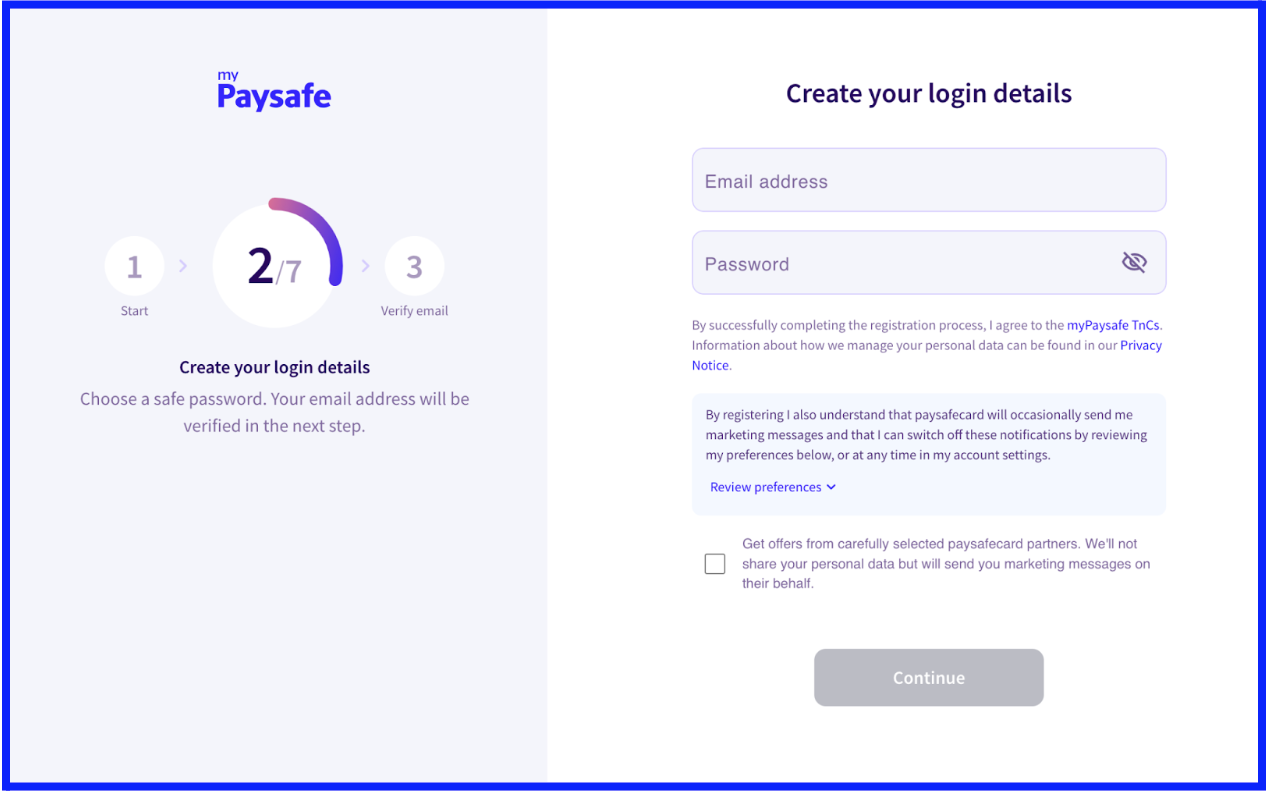

Creating a paysafecard account is a straightforward process that opens up a world of secure online transactions. Follow these steps, accompanied by handy screenshots for visual guidance: 1. Visit the official paysafecard website: Begin by navigating to the official paysafecard website.2. Click on 'Sign Up': Look for the 'Sign Up' button on the homepage and click it. 3. Enter your details: Fill in the required information, including your country, email address, and a secure password.

3. Enter your details: Fill in the required information, including your country, email address, and a secure password.

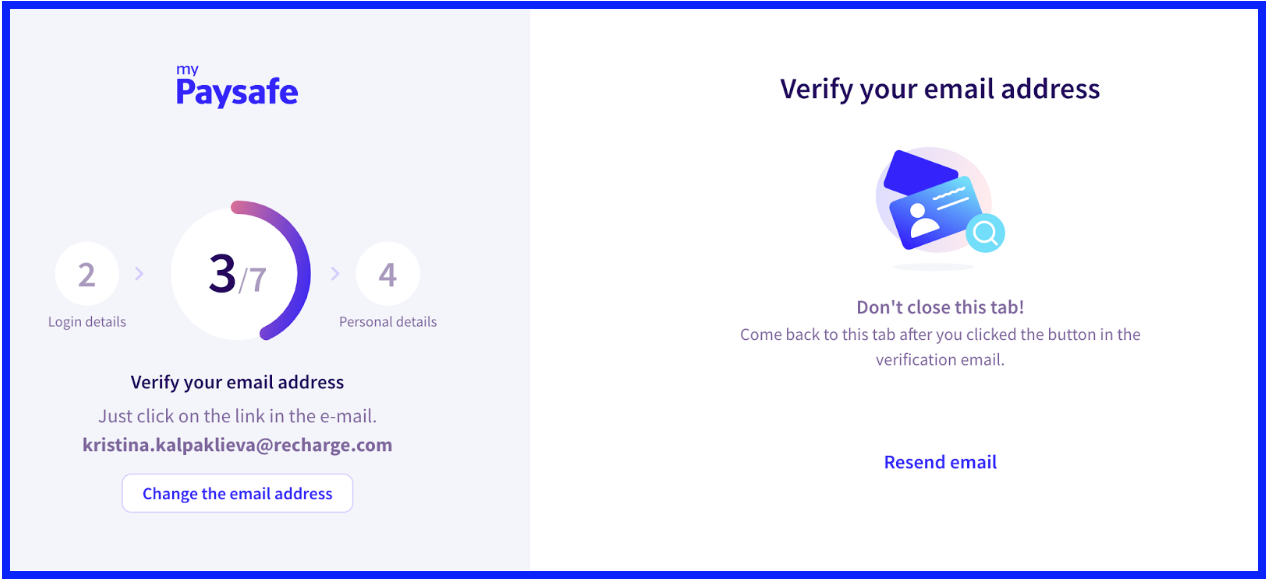

4. Verification code: You'll receive a verification code in your email. Enter this code on the registration page to verify your email address.

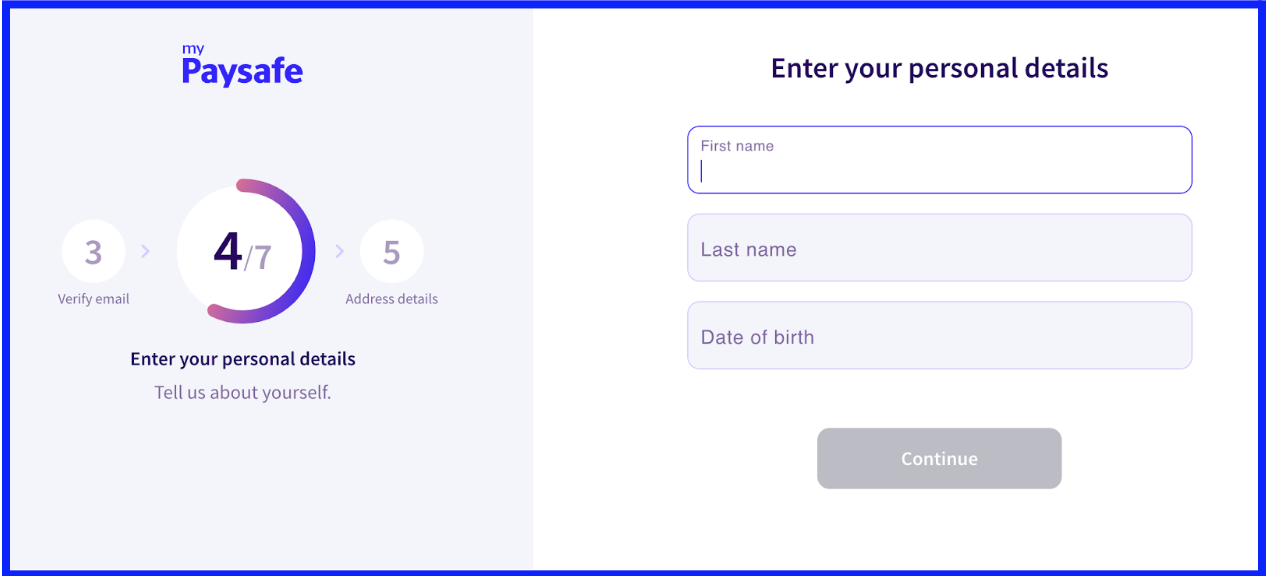

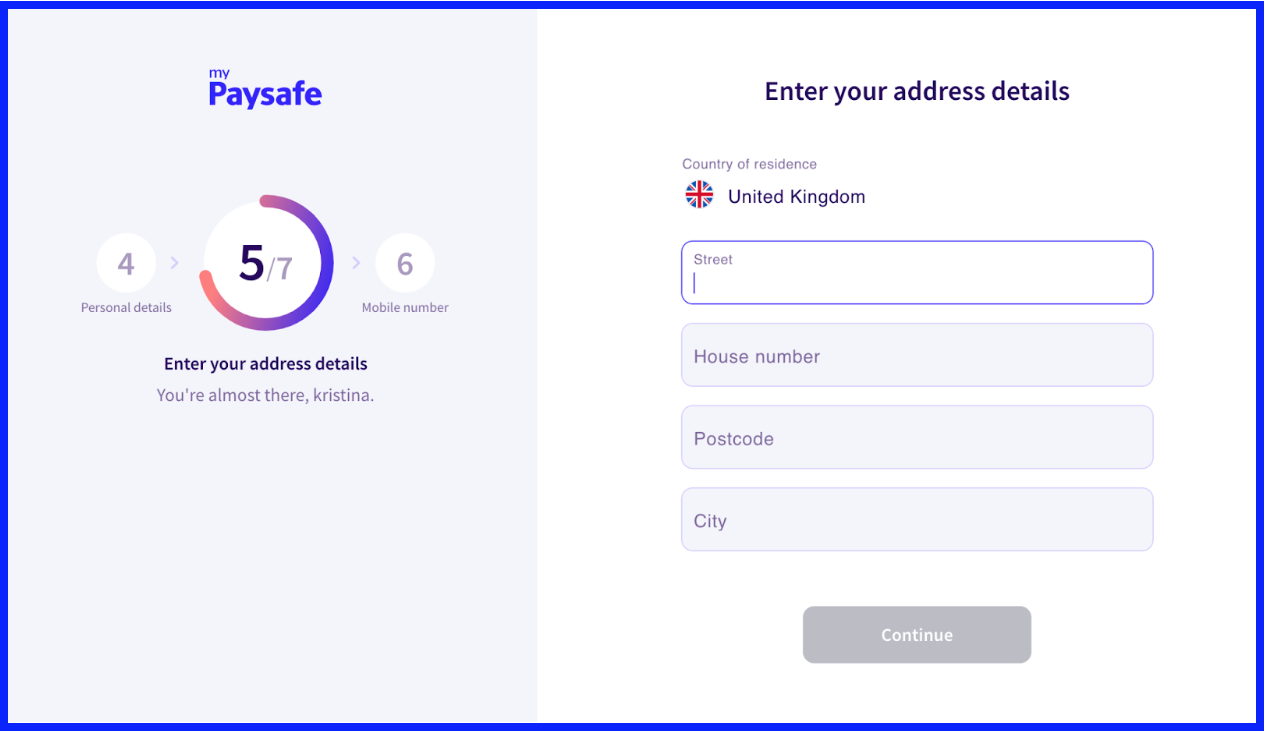

4. Verification code: You'll receive a verification code in your email. Enter this code on the registration page to verify your email address. 5. Complete the registration: After verifying your email, you'll need to provide some additional personal details to complete the registration process.

5. Complete the registration: After verifying your email, you'll need to provide some additional personal details to complete the registration process.

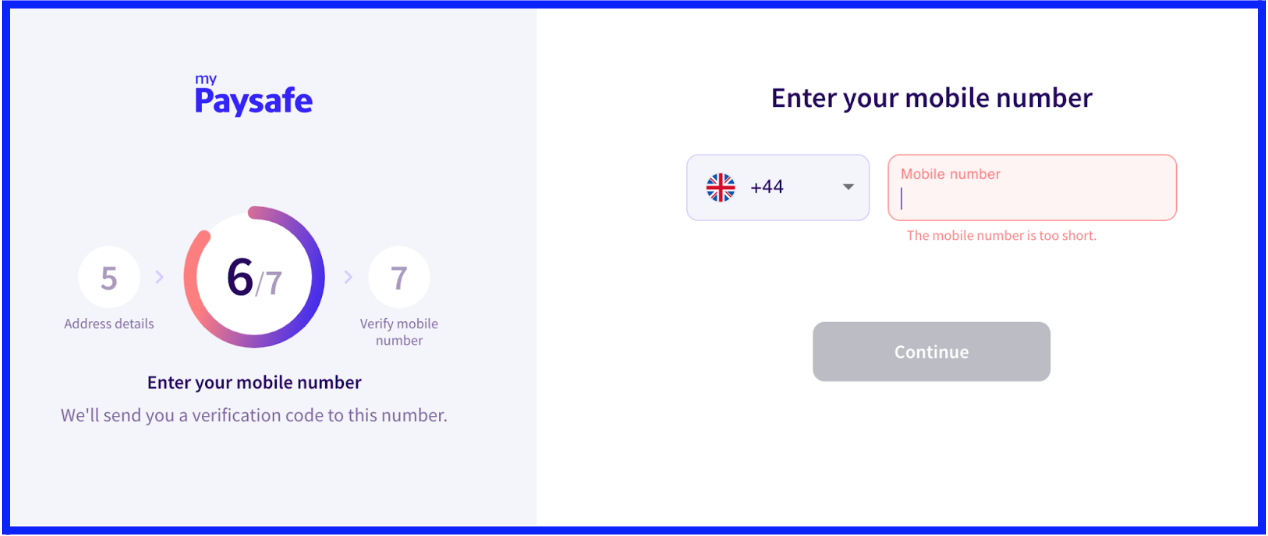

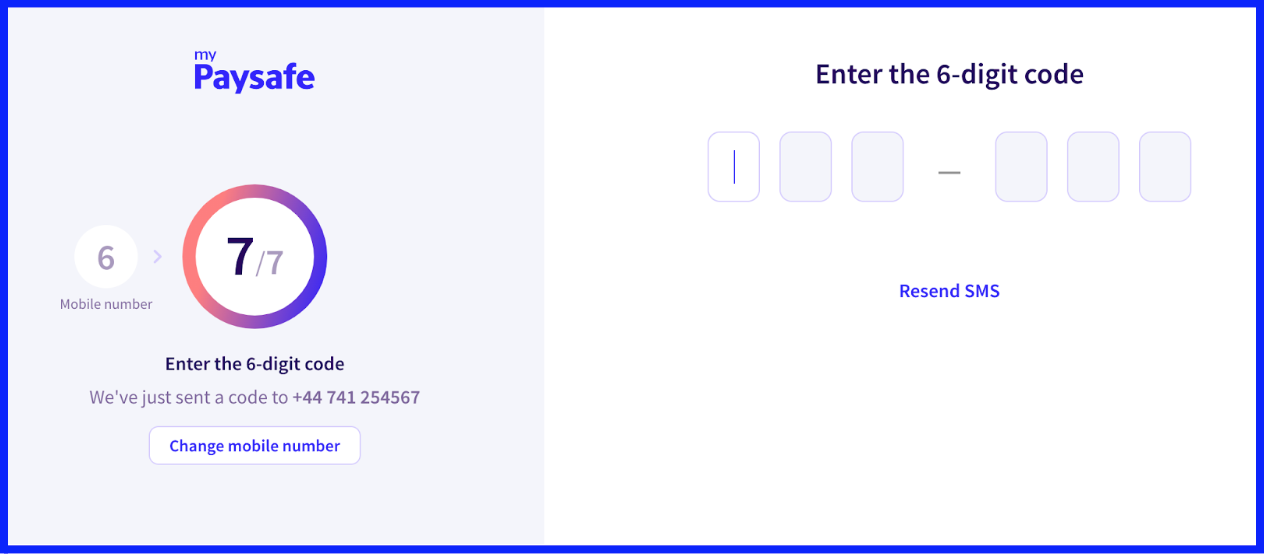

6. Enter your 6-digit verification code: Enter the code sent to your phone number for verification.

6. Enter your 6-digit verification code: Enter the code sent to your phone number for verification.  7. Create a 4-digit PIN: Set up a 4-digit PIN that will serve as an additional security measure when using your paysafecard account.8. Agree to Terms and Conditions: Review paysafecard's terms and conditions and agree to them.9. Verification: To enhance security and unlock certain features, you may be required to complete a verification process. This typically involves uploading a copy of your identification document.10. Add funds: With your paysafecard account successfully created, you can proceed to buy paysafecard online and add funds to it. You can easily purchase your paysafecard PINs through authorised outlets, such as Mobiletopup.co.uk, or using other available methods for topping up your account. 11. Start making secure payments: Your paysafecard account is now ready for use. You can make secure online payments with ease.

7. Create a 4-digit PIN: Set up a 4-digit PIN that will serve as an additional security measure when using your paysafecard account.8. Agree to Terms and Conditions: Review paysafecard's terms and conditions and agree to them.9. Verification: To enhance security and unlock certain features, you may be required to complete a verification process. This typically involves uploading a copy of your identification document.10. Add funds: With your paysafecard account successfully created, you can proceed to buy paysafecard online and add funds to it. You can easily purchase your paysafecard PINs through authorised outlets, such as Mobiletopup.co.uk, or using other available methods for topping up your account. 11. Start making secure payments: Your paysafecard account is now ready for use. You can make secure online payments with ease.

Pros of having a MyPaysafe account

Creating and owning a paysafecard account comes with a host of advantages that elevate your online payment experience. In this section, we'll delve deeper into these benefits to help you understand how a MyPaysafe account can enhance your digital transactions.1. Streamlined payments

One of the primary benefits of a paysafecard account is the ability to streamline your payments. When you have multiple paysafecard PINs or funds in your account, you can consolidate them all within your MyPaysafe account. This consolidation simplifies your payments, making it easy to manage your balance and make payments without needing to remember multiple PINs. Having a single account significantly enhances your payment experience, whether you're shopping online, gaming, or engaging in various digital activities.2. Higher transaction limits

Compared to using individual paysafecard codes, a MyPaysafe account offers higher transaction limits. While individual paysafecard codes typically have a maximum transaction limit of up to 40 GBP, a paysafecard account allows transactions of up to 1,000 GBP. This higher limit provides greater flexibility and convenience, especially when dealing with larger transactions or managing substantial funds for various online activities.3. Monthly maintenance fee

With a MyPaysafe account, you can enjoy benefits related to the monthly maintenance fee. While both paysafecard PINs and paysafecard accounts may incur a monthly fee, paysafecard accounts come with an advantage. The monthly maintenance fee for MyPaysafe accounts is only applicable from the 13th month onwards. This means that for the first 12 months of owning your account, you can enjoy its benefits without worrying about the monthly fee. It's a cost-effective choice for long-term users.4. Enhanced security

Security is paramount when it comes to online transactions, and paysafecard accounts are designed with this in mind. Centralising your funds in your account reduces the risk of managing physical PINs. Additionally, MyPaysafe accounts provide an added layer of security by allowing you to set a 4-digit PIN during registration. This ensures that only you can authorise transactions.5. Access to promotions

For those who appreciate added value, MyPaysafe accounts often provide access to exclusive promotions and bonuses. These promotions can include discounts, cashback offers, or special deals with partner websites and online platforms. When you create a paysafecard account, you can enjoy attractive offers and make your online spending more cost-effective.6. Transaction History

Having transparency in your financial transactions is crucial, and MyPaysafe accounts make it effortless. Having your personal paysafecard account, you have the ability to view your transaction history at any time. This feature allows you to keep tabs on your spending, review past purchases, and run a paysafecard balance check when you need to. It's a valuable tool for managing your finances and ensuring that your online transactions align with your budget.7. Convenient mobile app

paysafecard offers a user-friendly mobile app that seamlessly integrates with your paysafecard account. This app allows you to easily check your account balance, view transaction history, and locate nearby sales outlets using the Sales Outlet Locator feature. The mobile app makes managing your account more convenient by providing essential account management tools on your smartphone.Having a MyPaysafe account is more than just a way to store your PINs; it's a gateway to a world of convenience and security in your online payments. The advantages of streamlined payments, enhanced security, access to promotions, transaction history transparency, and the convenience of a mobile app make a paysafecard account a valuable asset for anyone engaged in digital transactions. Whether you're an avid online shopper, gamer, or simply someone who values secure and hassle-free payments, a paysafecard account elevates your online experience.Requirements for a paysafecard account

Setting up a MyPaysafe account is simple, but certain requirements must be met for eligibility and a smooth account setup. Here are the requirements in more detail:1. Minimum age

In the UK, you must be at least 16 years old in order to create a MyPaysafe account. The same minimum age requirement applies if you’re purchasing a paysafecard code online, without having an account. To purchase a paysafecard voucher in a physical shop, you must be at least 18 years old. These age requirements ensure compliance with legal regulations for online financial transactions. paysafecard enforces this to maintain platform integrity and security.2. Valid email address

Having a valid and accessible email address is a fundamental requirement for registering your paysafecard account. Your email address is not only used for communication but also serves as a vital component of account verification and recovery processes. Ensure that the email address you provide during registration is accurate and regularly checked to receive important notifications and updates related to your paysafecard account.3. Identification document requirements

Depending on your country of residence and the specific services you plan to use within your paysafecard account, you may be subject to identification verification. This verification process usually involves submitting a copy of an identification document, e.g. a passport or driver's license. Its primary objectives are to improve security, prevent fraudulent activities, and ensure compliance with relevant regulatory standards. Please note that not all users may need to undergo verification. The necessity of verification can vary based on the location and services accessed within the paysafecard account.By satisfying these requirements, you can proceed with confidence in creating your paysafecard account, knowing that you meet the necessary criteria for eligibility. These requirements play a crucial role in safeguarding your online financial activities and maintaining a secure and reliable platform for all users.Account limitations

While paysafecard accounts offer numerous benefits, it's important to be aware of certain limitations:1. Monthly top-up limits

When using your paysafecard account, you should be aware that there might be limits imposed on how much you can load onto your account. These limits are not one-size-fits-all and can vary based on factors such as your country of residence and your verification status. In the UK, your monthly top-up limit is 250 GBP. It's important to understand the limits of your paysafecard account, especially if you're making larger transactions or have specific financial requirements. This will help you plan your payments effectively and ensure that you don't exceed your account's defined funding limits. If the limits of a Standard account don’t suit your needs, you may want to consider a paysafecard Unlimited upgrade.2. Withdrawal limitations

paysafecard accounts are meant for making online payments and do not include the option for direct fund withdrawals like traditional bank accounts. Instead, they provide a secure and easy way to conduct transactions online, without the need for physical cash withdrawals from ATMs.Understanding this limitation is crucial to manage your financial expectations effectively. Instead of directly withdrawing funds, paysafecard users can utilise their account balance to make online payments at various supported merchants and platforms. This design ensures that your funds remain secure within the digital realm, ready for your online spending needs.If cash withdrawals from an ATM are an important functionality for you, you might consider getting a paysafecard Mastercard.Is it secure to create a paysafecard account?

Security is paramount in online payments, and paysafecard ensures a secure account creation process. Here's a concise overview of the key security aspects:- Robust encryption: Your personal information is protected by strong encryption protocols during account creation, ensuring its safety during transmission and storage.

- The 4-digit PIN: An extra layer of security is added to your paysafecard account with a 4-digit PIN, ensuring that only you can access and authorise transactions.

- Your role in security: While paysafecard takes significant security measures, your active participation is crucial. Maintain confidential login credentials, regularly monitor transactions, and use secure devices to enhance account security.