How to use Apple Pay: Your comprehensive guide

28 June 2024Apple Pay has revolutionised the way we make payments in the UK and around the world. So, what is Apple Pay? Launched in 2014, Apple’s mobile payment system lets users make secure, contactless purchases. Apple Pay works on iPhones, Apple Watches, iPads and Macs. By replacing your physical wallet with a virtual one on your Apple device, Apple Pay provides a convenient and cashless way to pay. Wondering how to use Apple Pay? You can use it in stores, online, within apps, and more. Keep reading to learn more.

In this comprehensive guide, we'll walk through all the requirements and steps to get set up with Apple Pay. We'll also cover key features, security tips, and troubleshooting advice to help you make the most of your mobile wallet.

Jump to the section you’re interested in:

The benefits of Apple Pay are numerous. It enhances security by:

It's contactless, so you can skip handling cash or cards. And it lets you pay with whichever bank cards or prepaid options you have loaded into the Wallet app. No wonder over 6,000 UK retailers like Sainsbury's, Lidl, and McDonald's already accept Apple Pay.

Apple Pay uses advanced security technology to protect your information when making purchases. Instead of your actual card numbers, a unique Device Account Number is assigned, encrypted, and stored securely in the Secure Element chip on your Apple Device.

When you make a purchase, Apple Pay uses this Device Account Number along with a dynamically generated one-time security code to process the payment. Your card details are never shared by Apple with merchants or transmitted during transactions.

Not sure how to use Apple Pay? You'll need one of these devices:

You'll also need an Apple ID signed into iCloud and a stable internet connection for the initial setup process. Your iPhone or iPad will need to have a passcode set up for security.

How to set up Apple Pay step-by-step

Once you’re happy your hardware, iOS version, and cards are eligible, you can easily add them to your Apple Pay wallet:

You can either use your device's camera to capture your card info or enter the details manually. Many banks will issue a verification code to enter, or you may need to call your bank to complete setup. After verification, your card will be added and you're ready to use Apple Pay!

Repeat these steps to add any additional debit, credit or prepaid cards* you wish to use with Apple Pay.

*If you want to use a prepaid card in Apple Pay, it needs to be a physical card. This is so you can provide information like the CVV (security code) as if it was a credit card. A PCS card is a good example. You can then top up the card at MobileTopUp.co.uk, where you can choose from a wide variety of payment methods.

While Apple Pay is accepted widely across the UK, you'll first need to check if your specific bank or card issuer is on the supported list.

Major UK banks like Barclays, HSBC, Lloyds, Nationwide, NatWest, Santander and more are compatible. Many popular credit cards like Visa, Mastercard, and American Express also work with Apple Pay.

One of the great benefits of Apple Pay is the ability to store multiple payment cards and easily switch between them as needed. When adding cards, you can set one as the default for making transactions.

To change your default payment card at any time, just open the Wallet app and tap on the card you want to use. Tap the "Make Default" button to update your preferences.

When you go to make a payment, your default card will be the one presented. But you can always switch to a different card before completing the transaction by tapping on it in your Apple Pay wallet.

Apple Pay itself doesn’t enforce any universal spending limits. However, the limits on each of your individual credit, debit or prepaid cards will still apply when making purchases through Apple Pay.

For debit cards, your bank's standard daily spending limit applies. For credit cards, your account's credit limit is what caps your Apple Pay spending.

Some merchants may also set their own Apple Pay limits on the transactions they allow. But in general, your own bank card's policies are what dictate the spending limits when using Apple Pay.

Security and privacy are major focuses for Apple Pay. Your card numbers are never shared or transmitted during transactions, thanks to the use of unique encrypted codes.

Face ID or Touch ID is required to authorise most Apple Pay purchases for added security. And if your iPhone or Watch is lost or stolen, you can easily use the Find My app to suspend all ability to make payments from that device.

For even greater security, you may want to consider using prepaid credit cards or gift cards instead of cards linked to your main bank accounts. Prepaid cards allow you to load a set amount of money onto the card, rather than exposing your primary accounts. They provide more control over spending and can easily be replaced if lost or compromised.

Some other tips for securing your Apple Pay usage:

One of the major conveniences of Apple Pay is its international compatibility and features for overseas travel. Apple Pay can be used in over 60 countries worldwide. When making foreign purchases, the standard exchange rates from your card issuers will apply.

You'll want to ensure your iPhone or iPad has an international data plan enabled before travelling abroad. This allows you to continue using Apple Pay's internet connectivity securely outside the UK.

A prepaid PCS card, which works just like a Mastercard, is a great option for controlling your funds when you travel. In France and Italy, prepaid Transcash cards are a popular option, also compatible with Apple Pay.

When buying or topping up a prepaid card, you should always check that spending outside the UK is allowed.

Within the UK mobile payments space, Apple Pay's top competitors are Google Pay (for Android users) and Samsung Pay (for Galaxy device owners).

All three digital wallet services have a very similar set of core features, such as:

But there are a few key differentiators for Apple Pay:

For iPhone owners specifically, Apple Pay provides the smoothest and most unified user experience. But all major mobile wallets are convenient and secure options in today's cashless society.

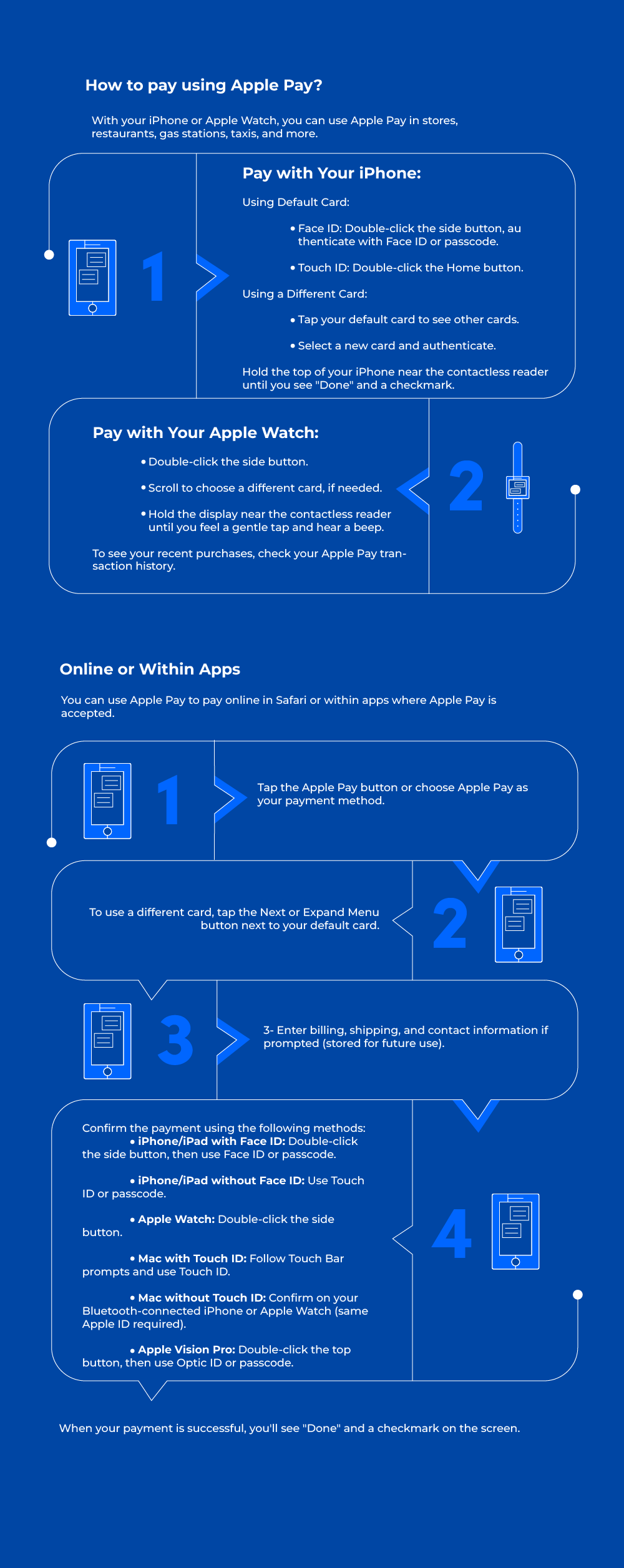

With your iPhone or Apple Watch, you can use Apple Pay in stores, restaurants, gas stations, taxis, and more.

If you encounter any difficulties setting up or using Apple Pay, try these troubleshooting tips…

For setup issues:

For purchase issues:

If all else fails, contact Apple Support for further assistance.

By following this comprehensive guide, you can take advantage of the supreme convenience and security of Apple Pay.

You may also like these articles

5 Apple Store products under £150

How to transfer data from iPhone to iPhone

The best voucher code browser extensions for the UK’s biggest online shopping periods

In this comprehensive guide, we'll walk through all the requirements and steps to get set up with Apple Pay. We'll also cover key features, security tips, and troubleshooting advice to help you make the most of your mobile wallet.

Jump to the section you’re interested in:

- Benefits of Apple Pay

- How does Apple Pay work?

- How to set up Apple Pay

- Checking bank and card compatibility

- Managing multiple cards in Apple Pay

- Is there an Apple Pay spending limit?

- How to use Apple Pay securely

- Using Apple Pay overseas

- Apple Pay vs other mobile wallets

- Managing Apple Pay settings

- Troubleshooting common issues

Benefits of Apple Pay

The benefits of Apple Pay are numerous. It enhances security by:

- Never sharing your actual card numbers with merchants

- Using tokenisation for transactions

It's contactless, so you can skip handling cash or cards. And it lets you pay with whichever bank cards or prepaid options you have loaded into the Wallet app. No wonder over 6,000 UK retailers like Sainsbury's, Lidl, and McDonald's already accept Apple Pay.

How Does Apple Pay work?

Apple Pay uses advanced security technology to protect your information when making purchases. Instead of your actual card numbers, a unique Device Account Number is assigned, encrypted, and stored securely in the Secure Element chip on your Apple Device.

When you make a purchase, Apple Pay uses this Device Account Number along with a dynamically generated one-time security code to process the payment. Your card details are never shared by Apple with merchants or transmitted during transactions.

How to set up Apple Pay

Not sure how to use Apple Pay? You'll need one of these devices:

- An iPhone 6 or newer model, running iOS 11 or later

- An iPad Pro, iPad Air 2, iPad mini 3 or newer running iOS 11 or later

- An Apple Watch paired with a compatible iPhone

You'll also need an Apple ID signed into iCloud and a stable internet connection for the initial setup process. Your iPhone or iPad will need to have a passcode set up for security.

How to set up Apple Pay step-by-step

Once you’re happy your hardware, iOS version, and cards are eligible, you can easily add them to your Apple Pay wallet:

- On your iPhone or iPad, open the Wallet app and tap the "+" icon in the top-right

- Tap "Add Credit or Debit Card" and follow the prompts

You can either use your device's camera to capture your card info or enter the details manually. Many banks will issue a verification code to enter, or you may need to call your bank to complete setup. After verification, your card will be added and you're ready to use Apple Pay!

Repeat these steps to add any additional debit, credit or prepaid cards* you wish to use with Apple Pay.

*If you want to use a prepaid card in Apple Pay, it needs to be a physical card. This is so you can provide information like the CVV (security code) as if it was a credit card. A PCS card is a good example. You can then top up the card at MobileTopUp.co.uk, where you can choose from a wide variety of payment methods.

Checking bank and card compatibility

While Apple Pay is accepted widely across the UK, you'll first need to check if your specific bank or card issuer is on the supported list.

Major UK banks like Barclays, HSBC, Lloyds, Nationwide, NatWest, Santander and more are compatible. Many popular credit cards like Visa, Mastercard, and American Express also work with Apple Pay.

Managing multiple cards in Apple Pay

One of the great benefits of Apple Pay is the ability to store multiple payment cards and easily switch between them as needed. When adding cards, you can set one as the default for making transactions.

To change your default payment card at any time, just open the Wallet app and tap on the card you want to use. Tap the "Make Default" button to update your preferences.

When you go to make a payment, your default card will be the one presented. But you can always switch to a different card before completing the transaction by tapping on it in your Apple Pay wallet.

Is there an Apple Pay spending limit?

Apple Pay itself doesn’t enforce any universal spending limits. However, the limits on each of your individual credit, debit or prepaid cards will still apply when making purchases through Apple Pay.

For debit cards, your bank's standard daily spending limit applies. For credit cards, your account's credit limit is what caps your Apple Pay spending.

Some merchants may also set their own Apple Pay limits on the transactions they allow. But in general, your own bank card's policies are what dictate the spending limits when using Apple Pay.

How to use Apple Pay securely

Security and privacy are major focuses for Apple Pay. Your card numbers are never shared or transmitted during transactions, thanks to the use of unique encrypted codes.

Face ID or Touch ID is required to authorise most Apple Pay purchases for added security. And if your iPhone or Watch is lost or stolen, you can easily use the Find My app to suspend all ability to make payments from that device.

For even greater security, you may want to consider using prepaid credit cards or gift cards instead of cards linked to your main bank accounts. Prepaid cards allow you to load a set amount of money onto the card, rather than exposing your primary accounts. They provide more control over spending and can easily be replaced if lost or compromised.

Some other tips for securing your Apple Pay usage:

- Enable two-factor authentication for your Apple ID

- Review transactions regularly in the Wallet app

- Use strong passcodes and Face ID/Touch ID for device security

- Only install apps from trusted sources like the App Store

Using Apple Pay overseas

One of the major conveniences of Apple Pay is its international compatibility and features for overseas travel. Apple Pay can be used in over 60 countries worldwide. When making foreign purchases, the standard exchange rates from your card issuers will apply.

You'll want to ensure your iPhone or iPad has an international data plan enabled before travelling abroad. This allows you to continue using Apple Pay's internet connectivity securely outside the UK.

A prepaid PCS card, which works just like a Mastercard, is a great option for controlling your funds when you travel. In France and Italy, prepaid Transcash cards are a popular option, also compatible with Apple Pay.

When buying or topping up a prepaid card, you should always check that spending outside the UK is allowed.

Apple Pay vs other mobile wallets

Within the UK mobile payments space, Apple Pay's top competitors are Google Pay (for Android users) and Samsung Pay (for Galaxy device owners).

All three digital wallet services have a very similar set of core features, such as:

- Storing payment cards

- Using biometrics for authorisation

- International support

- Tokenized transactions

But there are a few key differentiators for Apple Pay:

- Integrates seamlessly across the Apple ecosystem (iPhone, iPad, Mac, Apple Watch)

- No need to open separate app—just double-click the side button

- More widespread UK retail adoption than Google/Samsung Pay

- Generally viewed as having the strongest security protocols

For iPhone owners specifically, Apple Pay provides the smoothest and most unified user experience. But all major mobile wallets are convenient and secure options in today's cashless society.

How to pay using Apple Pay?

With your iPhone or Apple Watch, you can use Apple Pay in stores, restaurants, gas stations, taxis, and more.

Troubleshooting common issues

If you encounter any difficulties setting up or using Apple Pay, try these troubleshooting tips…

For setup issues:

- Ensure you meet all system requirements (device, iOS version, etc.)

- Remove and re-add the payment card having issues

- Update to the latest iOS version and restart the device

- Contact your bank for additional verification if prompted

For purchase issues:

- Ensure your default card is current and hasn't expired

- Check that Apple Pay is actually accepted by that merchant

- Turn off WiFi and use mobile data for better connectivity

- Disable VPN if you have one enabled

If all else fails, contact Apple Support for further assistance.

By following this comprehensive guide, you can take advantage of the supreme convenience and security of Apple Pay.

You may also like these articles

5 Apple Store products under £150

How to transfer data from iPhone to iPhone

The best voucher code browser extensions for the UK’s biggest online shopping periods